Market Review – December 2025

Key Themes

- Australian equities rose while unhedged international equities fell:

Australian equities were supported by rising materials prices, while international equities suffered from profit-taking around the Magnificent Seven. - Both Australian and international bonds fell:

Bond prices declined and yields rose as the market weighed the potential for persistent inflation and elevated central bank rates in 2026. - Australian dollar strengthened:

A weakening US dollar and rising commodity prices supported the Australian dollar. - Oil continued its decline; gold moved higher:

Oversupply and lower demand weighed on oil prices, while US rate cuts supported gold.

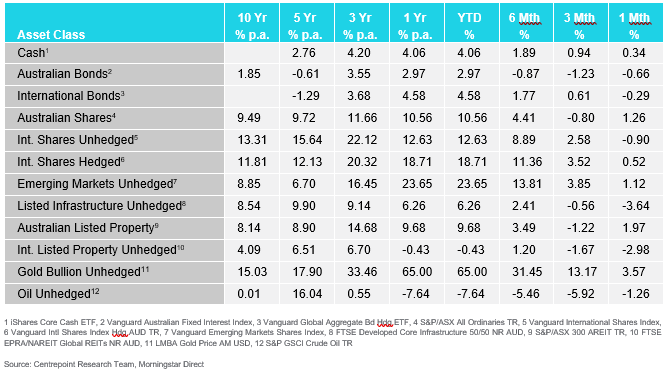

How the different asset classes have fared

(As at 31st December)

International Equities

In December, hedged international equities rose by 0.52%, while unhedged equities fell by 0.90%. The outperformance of hedged positions was driven by the appreciation of the Australian dollar against the US dollar, which increased the value of investments held in Australian dollars.

The S&P 500 delivered a modest return of 0.48% for the month, lagging other markets after a four-day sell-off at year-end. This decline was largely the result of profit-taking, particularly among the Magnificent Seven, which continued to dominate market performance throughout 2025.

Earlier in the month, uncertainty emerged as delayed economic data releases caused by the US government shutdown sent mixed signals. Employment and inflation figures were lower than expected, while third-quarter GDP remained strong.

Emerging markets continued their strong performance, gaining 1.12% in December and closing the year with an impressive return of 23.65%, significantly outperforming other major markets. Growth was concentrated in technology stocks in Taiwan and South Korea, including companies such as TSMC.

Additional support came from the depreciation of the US dollar, which reduced debt burdens in emerging economies and boosted commodity prices.

Australian Equities

Australian equities rose by 1.26% in December, outperforming international equities. Gains were driven primarily by strong materials prices, including gold, silver, copper, and lithium, which lifted mining companies and delivered a 6.34% return for the Materials sector.

The Financials sector also contributed, rising by 4.40%, as the Reserve Bank of Australia’s decision to hold rates supported smaller financial stocks and allowed major banks to recover modestly following weakness in November. The Real Estate sector added to performance with a 1.20% gain.

However, the broader market remained mixed, with all remaining sectors ending the month in negative territory. This highlights how sector concentration in the Australian market can significantly influence overall returns.

Technology declined sharply by 7.44% amid concerns about a potential RBA rate hike in 2026 and elevated valuations. Healthcare fell by 5.60%, finishing the year as the worst-performing sector on the ASX. Lower oil prices also weighed on Energy, which declined by 2.38%.

Domestic and International Fixed Income

International bonds finished December slightly lower, declining by 0.29%. Although the US Federal Reserve cut its policy rate by 25 basis points, the decision was narrowly passed by a 9–3 vote and was accompanied by forecasts suggesting only one rate cut in 2026.

As a result, yields on 10-year US government bonds edged higher as markets priced in the likelihood of persistently elevated inflation.

Australian bonds underperformed international peers, falling by 0.66% during the month. The Reserve Bank of Australia left the cash rate unchanged, citing persistent inflation and a resilient labour market.

Hawkish commentary from the RBA contributed to rising yields on both 2-year and 10-year Australian government bonds, as investors adjusted expectations for interest rates to remain higher for longer.

Australian Dollar

The Australian dollar strengthened by 1.47% against the US dollar in December, rising from 0.66 to 0.67 AUD/USD. The US dollar weakened following the Federal Reserve’s rate cut, making alternative currencies more attractive.

At the same time, rising commodity prices supported the Australian dollar by increasing the value of Australia’s resource exports.

Commodities – Gold and Oil

Oil prices continued to decline in December, falling by 1.26%. This weakness reflected oversupply concerns as OPEC+ unwound production cuts, alongside softening demand amid slowing global growth.

Gold rose by 3.57% during the month, surpassing US$4,500 per troy ounce for the first time. Gains were supported by the Federal Reserve’s rate cut and a weaker US dollar, which reduced the opportunity cost of holding gold.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.