Federal Budget Summary – May 2024

Introduction

On the evening of 14 May 2024, the Government delivered what is possibly its last Budget in the current parliamentary term. The next election is expected to be held either late this year or early in 2025.

Inflation, cost of living pressures, and housing all continue to dominate the fiscal landscape, impacting the lives of Australians.

The key challenges addressed in this year’s Budget include:

- Easing cost of living and inflationary pressures,

- Building more houses,

- Strengthening Medicare and the care economy.

Importantly, the measures announced in the Budget are not a fait accompli. They will be subject to the successful passage of relevant legislation.

Highlights

The state of the economy

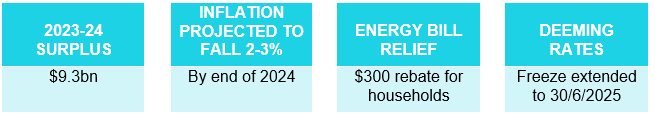

The Treasurer announced a pleasing $9.3bn surplus for the 2023-24 financial year. This is the second consecutive surplus however deficits have been forecast for the next three financial years as the government embarks on what it describes as “unavoidable spending.”

Real GDP growth is expected to continue to improve from 1¾% in 2023-24 to 2¾% by 2027-28

The unemployment rate in recent years has placed Australia in an enviable position. The current historically low unemployment rate is expected to increase marginally in 2024-25 to 4½%.

As announced previously, the Government predicts the inflation rate will continue to fall, returning to the Reserve Bank of Australia’s target range of 2 – 3% by the end of 2024.

Now for a more detailed look at some of the key announcements impacting you from a financial planning perspective.

Superannuation

The Budget was remarkably silent of superannuation changes with two exceptions:

Superannuation on Paid Parental Leave

From 1 July 2025, superannuation guarantee contributions of 12% will be paid on all Commonwealth funded paid parental leave payments.

Enforcement activity and unpaid super

The Government will provide additional funds from 1 July 2024 to strengthen the ATOs ability to detect, prevent and mitigate fraud against the tax and superannuation systems.

The Fair Entitlements Guarantee Recovery Program will be recalibrated to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy from 1 July 2024.

Missed opportunity

The previous government had proposed introducing an amnesty that would allow members of superannuation funds that were locked into old style legacy pension products to exit those products without incurring adverse tax or social security consequences. While we understand the current government is favourably disposed towards this, the Budget was silent on this initiative.

In addition to the amnesty for legacy pensions, simplification to the way self-managed super funds are managed when members moved overseas had previously been proposed. Sadly, this Budget has not advanced those proposals.

Income Tax

The Budget reconfirms that 13.6 million Australian taxpayers will receive tax cuts from 1 July 2024. These changes have previously been legislated in the form of the amended Stage 3 tax cuts.

Small Business

Instant asset write off

Small businesses with an annual turnover of less than $10 million will have the current instant write-off of assets extended for another year to 30 June 2025. This will apply to assets costing less than $20,000 that are first used or installed ready for use by 30 June 2025. The asset threshold applies per asset so small businesses could instantly write off multiple assets.

Aged Care

The Government continues to focus on increased wages for aged care workers, funding to help improve the quality of care for both home care recipients and those in residential care facilities, and additional funding to implement recommendations identified in the Royal Commission into Aged Care.

On 3 April 2024, the Government announced that the commencement of a new Aged Care Act will be deferred. Originally the new Act was to commence on 1 July 2024. It will now commence from 1 July 2025.

This is in response to recommendations made in the Final Report of the Aged Care Task Force which was released in March 2024. This report proposed several key changes, including the:

- calculation of home care and residential care co-contributions

- phase out of lump sum accommodation payments, and

- reintroduction of a retention amount.

The Government will provide $2.2 billion over five years from 2023–24 to deliver key aged care reforms and to continue to implement recommendations from the Royal Commission into Aged Care Quality and Safety.

More Home Care Packages

Most Australians want to be able to age in place and remain in their homes as long as they are able. To support older Australians, the Government is investing $531.4 million to release an additional 24,100 Home Care Packages in 2024–25 to reduce average wait times and to support people to age at home if that is their preference.

Welfare

Supporting Australians with cost-of-living relief at the same time as implementing measures to place downward pressure on inflation was once again a key focus for the Government in relation to welfare announcements. Energy cost relief for all Australian households, further increases to Rent Assistance, significant spending on social housing and reducing the impact of indexation on student loans are a feature.

$300 Energy Bill Relief

The Government will provide $3.5 billion over the next three years to extend and expand the Energy Bill Relief Fund to provide a $300 rebate to all Australian households and a $325 rebate to eligible small businesses on 2024–25 bills.

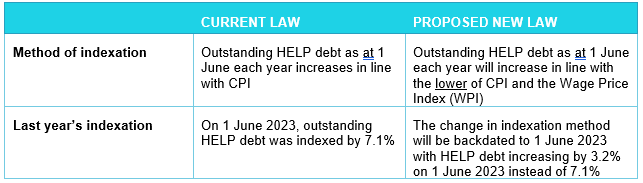

HELP indexation

Tonight, the Government confirmed a previously announced measure to change the way Higher Education Loan Program (HELP) debt is indexed. As a result, $3 billion in student debt will be cut.

Two measures have been proposed as follows:

Students who had their loans indexed on 1 June 2023 and will be subject to indexation on 1 June 2024, will receive an indexation credit. The indexation credit can be estimated using the Government’s HELP Indexation Credit Estimator.

Social Security

This year’s budget provides good news for pensioners concerned about predicted increases in the deeming rates, waiting times when corresponding with Centrelink staff as well as those needing additional support with rising rental prices.

Deeming Rates

The Government will freeze social security deeming rates at their current levels for a further 12 months until 30 June 2025, to support Age Pensioners and other income support recipients who rely on income from deemed financial investments, as well as their pension payments, to manage cost of living pressures.

It was anticipated that the current low deeming rates of 0.25% and 2.25% would increase from 1 July 2024 after a two-year freeze, impacting many pensioners. Fortunately, pensioners will now have comfort knowing that these low rates will be retained for at least another year.

Increased flexibility for those on Carer Payment

Currently, to be eligible for a Carer Payment, a carer has a participation limit of 25 hours per week which includes employment, study, volunteering activities and travel time to and from work.

From 20 March 2025, Carer Payment recipients will have increased flexibility to undertake work, study, and volunteering activities whereby recipient’s participation limit will be amended to 100 hours over four weeks and will only apply to employment.

Additionally, if the participation limit is exceeded, payments will be suspended for up to six months, rather than being cancelled.

Support to help combat rental affordability

With rental prices in most Australian locations increasing rapidly over the past decade, rental affordability for many, including those on Government income support and family benefits, is a major concern.

After an increase in Rent Assistance in last year’s budget of 15%, the Government is providing a further $1.9 billion over five years to increase maximum rates of Rent Assistance by a further 10%.

Increase in JobSeeker rate for those with partial capacity to work

The higher rate of JobSeeker Payment, a boost of at least $54.90 per fortnight, will be extended to single recipients with a partial capacity to work of zero to 14 hours per week from 20 September 2024.

Boost to Centrelink resources

The Government will set aside $2.8 billion over the next five years in an attempt to improve the way Services Australia (Centrelink) delivers services to the Australian community.

The funding is earmarked to assist with:

- additional frontline staff to help with claims and services

- sustaining the myGov platform and ensuring continued development of its capability

- enhance safety and security at Services Australia centres including an increased security presence and enhancements to service centre design.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.