Market Review – August 2025

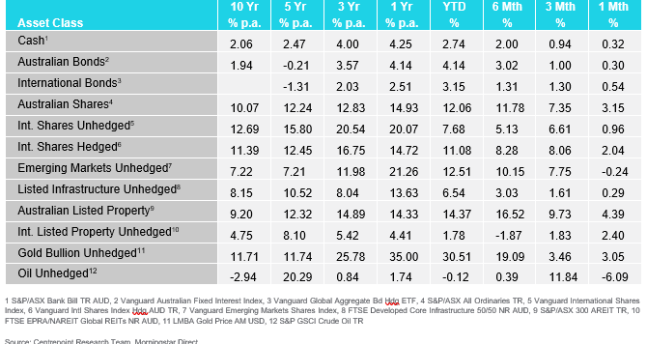

How the different asset classes have fared:

(As at 31 August 2025)

Key Themes:

· Equities rose: Both international and Australian equities continued to climb, gaining 0.96% and 3.05%, respectively. International equities were supported by a strong reporting season, while Australian equities outperformed in the materials sector.

· Bond prices ended slightly higher: International bond yields fell at the short end of the curve after Jerome Powell signalled to the market that interest rate cuts are coming. The long end of the curve rose as momentum grew behind the idea of entering a higher fiscal spending environment. As a result, the yield curve steepened.

· Australian dollar appreciated: The Australian dollar strengthened against the US dollar, driven by a higher likelihood of US rate cuts putting downward pressure on the USD, alongside an appreciation of the AUD supported by a rally in commodities.

· Oil fell, Gold reached all-time highs: Oil declined as concerns over future demand lingered. Gold reached new highs on the back of impending US rate cuts, continued central bank buying, and a weaker US dollar.

International Equities:

International equities rose in August. Unhedged international equities gained 0.96%, while the hedged share class returned a higher 2.04%, buoyed by a continuation of a weaker US dollar. In the United States, the S&P 500 rose 1.9%, marking its fourth consecutive monthly gain, while the technology-heavy NASDAQ gained 1.2%. The “Magnificent Seven” continued to drive performance following strong second-quarter earnings and now account for around 34% of the index, exerting significant influence on overall returns. Despite this concentration, gains were broad-based in August, with the Equal-Weighted S&P 500 rising 2.7% on the back of robust Q2 earnings, as approximately 80% of companies beat expectations (the highest since 2021). However, investor sentiment was tempered by a downward revision to Non-Farm Payrolls, fuelling concerns about a softening labour market.

Elsewhere, Japan performed strongly, with the TOPIX gaining 2.6% and reaching new highs, supported by renewed investor interest following a trade deal with the US and stronger-than-expected Q2 economic growth. Europe also advanced, finishing the month 1.2% higher, aided by a PMI reading of 51.1, signalling expansion and boosting investor confidence. China ended the month in positive territory as well, following government announcements of higher AI chip production targets and the extension of a US–China trade deal deadline.

Australian Equities

Australian equities performed well in August, rising 3.14%. The ASX 200 reached all-time highs early in the month before easing slightly following weaker-than-expected earnings results. Although reporting season was less impressive than in the US, the materials sector provided support to index returns. Tailwinds included gold surpassing USD $3,400 and a sharp increase in lithium prices driven by supply cuts in China. Australian small caps also performed strongly, with the ASX Small Ordinaries Index gaining 9.4% as investors positioned for potential interest rate cuts. Small caps, which are often more interest-rate sensitive due to higher debt levels, outperformed large caps. In contrast, the financials sector underperformed, as stretched valuations remained a concern.

Domestic and International Fixed Income

International fixed income returned 0.54% in August, reflecting a slight decline in global bond yields. Much of the gain came after a speech by Jerome Powell, which led investors to price in a higher probability of a September rate cut. Falling inflation and signs of labour market weakness underpinned Powell’s dovish tone. Following the speech, short-dated yields declined more sharply, contributing to a general steepening of the yield curve. In contrast, long-dated bond yields rose as momentum built around expectations of a higher fiscal spending environment.

Australian fixed income also advanced, returning 0.30%, as bond yields declined modestly. Short-dated yields fell over the month amid hopes of RBA rate cuts, although the move was less pronounced than in global markets, particularly the US. Long-dated yields followed the international trend, rising in August and resulting in a steeper yield curve.

Australian Dollar

The Australian dollar strengthened in August against the US dollar. The move was largely US dollar-driven, as the US Dollar Index (which measures the USD against a basket of major currencies) fell by approximately 2.5%. Anticipation of further Federal Reserve rate cuts, combined with signs of a weakening US economy, placed downward pressure on the greenback. In contrast, a rally in commodity prices provided a tailwind to the Australian dollar, further supporting its relative performance.

Commodities – Gold and Oil

Oil declined 6.09% in August as concerns over future demand weighed on investor sentiment. Slowing economic growth globally—particularly in the US and China, which together account for a significant share of oil consumption—added uncertainty around demand. In addition, OPEC+ unexpectedly opted to slightly increase production, further pressuring prices. The combination of weaker demand expectations and higher supply contributed to the decline in oil.

Gold rose 3.05% in August, reaching new all-time highs. The increase was supported by several factors, including stronger demand from central banks and rising expectations of US interest rate cuts. At the same time, the decline in the US dollar boosted demand from foreign investors.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.