Market Review – January 2026

Key Themes

- Equities broadly rose in January: Australian equities were supported by higher commodity prices, while international equities brushed off geopolitical conflicts and rose broadly, with small- and mid-caps outperforming large caps.

- Both Australian and international bonds ended slightly higher: Bond prices rose and yields declined as inflation appeared to be contained internationally. In Australia, sticky inflation remained a concern; however, the bond market ended the month slightly positive.

- Australian dollar strengthened: A weakening USD and rising commodity prices supported the Australian dollar.

- Oil saw the best performance since 2022; gold also had a stellar month: Tensions in the Middle East provided a strong tailwind for oil, while gold rose due to its safe-haven qualities.

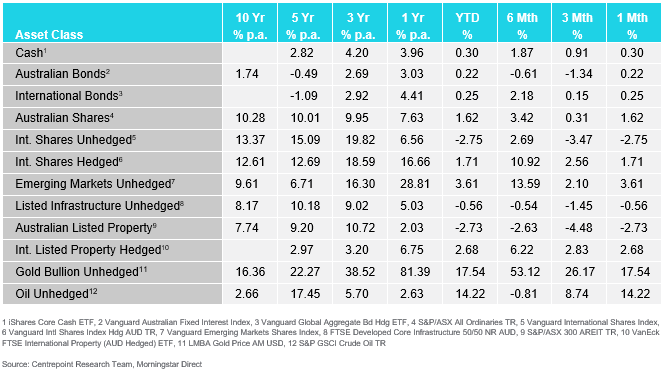

How the different asset classes have fared

(As at 31st January)

International Equities

Global equities rose as the rally broadened beyond large US technology stocks. The MSCI World Index gained 2.30% in USD terms, while emerging markets performed even more strongly, supported by a weaker US dollar and robust performance from Asian markets such as China and Japan. US equities also advanced, with the S&P 500 up 1.53% for the month following solid early earnings releases and contained inflation readings.

However, volatility persisted due to renewed geopolitical tensions and discussions around trade policy. January saw several bouts of volatility, including US military action in Venezuela, threats of potential strikes on Iran, and rising friction between the US and NATO allies over Greenland. President Donald Trump also reignited tariff threats towards Europe and Canada, posing further uncertainty; however, investors appeared to take these threats less seriously than in the past, reflecting the so-called TACO (Trump Always Chickens Out) notion.

Market breadth continued to improve, with small- and mid-cap equities outperforming large caps across many regions. This rotation supported value and cyclical exposures, reinforcing the shift that began late in 2025. Europe also delivered positive returns as inflation data moderated across the eurozone and investor sentiment stabilised following mid-month tariff concerns from the United States.

Australian Equities

Australian equities gained 1.62% in January, driven primarily by higher commodity prices. The materials sector was a significant beneficiary of rising gold, copper, and broader resource prices, providing a strong foundation for the month’s gains. Energy also contributed positively as oil prices rallied in the wake of geopolitical developments in Iran and Venezuela.

In contrast, financials and technology underperformed as markets adjusted expectations for the Reserve Bank of Australia (RBA) to maintain a higher-for-longer policy stance, following strong labour market data and ongoing inflationary pressures in early 2026.

Domestic and International Fixed Income

In Australia, fixed income returned 0.22%. While sticky inflation remained at the forefront of investors’ minds, putting upward pressure on yields, the bond market managed to end the month in positive territory. Strong income generated from an environment of elevated bond yields supported returns, and while the RBA increased interest rates at the start of February, much of this was already priced into the market.

Global fixed income markets saw uneven performance. Long-dated yields rose in Japan as fiscal concerns placed upward pressure on longer-duration bonds, while yields fell in Germany, where inflation moderated more than expected. Corporate bonds performed well globally, supported by tighter spreads and increased investor risk appetite amid improving activity data and modest inflation prints.

In the United States, front-end yields moved higher as markets pushed expectations for the next Federal Reserve rate cut further out. This followed the nomination of Kevin Warsh as the prospective Fed Chair, which triggered a late-month USD rally and added to volatility across bond markets. Kevin Warsh is likely to implement a more hawkish stance, implying higher rates for longer, which weighed on sentiment for longer-duration assets.

Australian Dollar

The Australian dollar benefited from earlier USD weakness and strong commodity prices through most of January. Stronger-than-expected economic data and sticky inflation reinforced expectations that the RBA would hike rates at its February meeting, providing a tailwind for the Australian dollar.

More broadly, the US dollar continued to weaken, offering additional support for the AUD/USD currency pair as investors priced in further rate cuts and risk sentiment improved. Currency markets experienced heightened volatility during the month amid geopolitical uncertainty, trade tensions, and divergent central bank outlooks across major economies.

Commodities – Gold and Oil

Oil prices rallied strongly, rising 14.22%, marking the best monthly performance since 2022, as escalating geopolitical tensions across the Middle East boosted risk premiums and demand for energy exposure.

Gold continued its upward trend but experienced a notable correction late in January as the US dollar strengthened. While precious metals benefited from geopolitical uncertainty earlier in the month, the USD strengthened in the final days of January as investors attempted to price in the potential appointment of an alternative US Federal Reserve Chair and the implications this could have for interest rates.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.