Market Review – June 2025

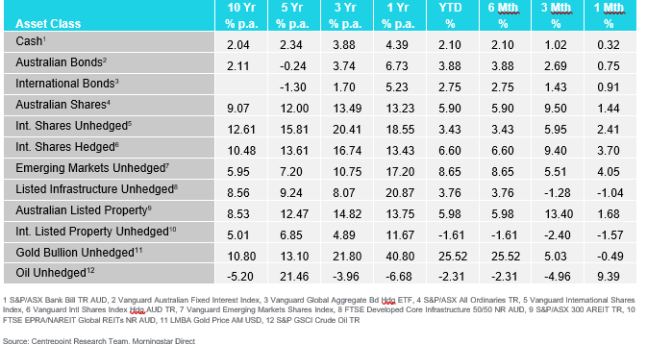

How the different asset classes have fared:

(As at 30 June 2025)

Key Themes:

· Equities rose: International equities gained as they continued to recover from the market correction triggered by the US tariff announcements on 2 April. Australian equities also rose, supported by strong performances from major banks and rising energy prices.

· Bond prices edged higher: Both international and Australian bond prices increased as inflation data came in below expectations and investors began to anticipate rate cuts in the second half of 2025.

· Australian dollar appreciated: The Australian dollar strengthened against a weakening US dollar amid growing concerns over the US government’s debt-to-GDP ratio.

· Oil and gold prices were mixed: Oil prices rose due to ongoing conflicts in the Middle East, while gold prices pulled back slightly after a remarkably strong start to the year.

International Equities:

International equities had a solid month in June, with unhedged equities rising by 2.41% and hedged equities gaining 3.70%. Hedged equities outperformed their unhedged counterparts due to the US dollar (USD) depreciating against the Australian dollar (AUD) throughout the month. This depreciation was driven by uncertainty surrounding the US economy and concerns over the sustainability of its debt-to-GDP ratio, particularly as President Trump attempted to pass the “Big Beautiful Bill”, which would increase US federal debt by $3.3 trillion over the next decade.

The three strongest performing sectors in international equities were Information Technology, Communication Services, and Energy, which rose by 9.20%, 7.03%, and 4.73% respectively. The Energy sector had climbed by 8.50% by 17 June, amid rising tensions between Israel and Iran and fears about disruptions to oil production and trade in the region. These concerns eased following a ceasefire announcement, which subsequently cooled gains in the Energy sector. Information Technology and Communication Services were among the weakest sectors in the first quarter of the year, and their strong performance in June reflects a continued rebound as investors returned to these areas.

The weakest performing sectors were Consumer Staples, which fell by 2.13%, as well as Real Estate and Utilities, which rose modestly by 0.44% and 1.29% respectively. In contrast to the top-performing sectors, these three had delivered strong returns during the first quarter of 2025 and have not experienced the same level of rebound. Real Estate stocks, in particular, saw limited growth in June, as the US Federal Reserve held off on cutting interest rates, opting to wait for more conclusive data on the trajectory of the economy and inflation.

Australian Equities

Australian equities posted slightly weaker gains than international markets, rising by 1.44% in June. Two standout sectors led the performance: Energy, which surged 9.01%, and Financials, which rose 4.28%. The next best-performing sector was Consumer Discretionary, up 1.51%. Similar to global markets, the Energy sector was buoyed by the conflict between Israel and Iran and its potential to disrupt oil production and trade in the region. Financials benefited from continued strength in major bank stocks, which performed well throughout June and the broader second quarter of 2025.

The three weakest sectors were Materials (-3.11%), Consumer Staples (-2.31%), and Utilities (-1.31%). The decline in Materials reflected concerns that escalating global trade barriers could reduce demand for Australian resources. While the Consumer Staples sector held up relatively well during the “Liberation Day” tariff announcements, investors have since rotated out of the sector in search of better opportunities among previously weaker areas that are now rebounding.

Domestic and International Fixed Income

International bond prices rose by 0.91% in June. The US 10-year government bond yield fell slightly to 4.23% and the US 2-year government bond yield fell by about the same amount to 3.72%. With the US inflation data for May coming in below expectations and other economic data softening in the US, investors are continuing to expect a US Federal Reserve rate cut in their September meeting and potentially further cuts later in the year as well. These expectations have contributed to the falling government bond yields and rising bond prices in the US. The potential impact of global tariffs on inflation seems to have already been priced into the yields and prices of US bonds.

Australian bond prices also rose in June, albeit slightly less than international bonds, growing by 0.75%. The Australian 10-year government bond yield fell to 4.17% and the 2-year government bond yield fell to 3.22%. The Australian CPI in May was 2.10%, down from 2.40% the month prior and the lowest level since November 2021. With inflation continuing to ease investors are expecting the Reserve Bank of Australia (RBA) to announce their third rate cut of the year in their July meeting. Easing inflation and expectations of further rate cuts have played a role in the falling yields and rising prices of Australian bonds.

Australian Dollar

In June, the Australian dollar appreciated by 2.07% against the US dollar. This movement was less a reflection of AUD strength and more a result of broad USD weakness. The US Dollar Index (DXY) declined by 2.47% during the month amid mounting concerns over the US debt-to-GDP ratio and the government’s ability to service its growing debt burden. These concerns intensified as President Trump advanced the “Big Beautiful Bill”, expected to add $3.3 trillion to US national debt over the next decade.

Commodities – Gold and Oil

The price of oil continued to climb in June, rising 9.39%, primarily driven by fears surrounding the Israel–Iran conflict and its potential to disrupt oil supply and trade flows in the Middle East. While the announcement of a ceasefire on 24 June helped ease tensions, residual effects continued to influence oil prices through the end of the month.

In contrast, gold prices edged lower by 0.49% in June. After an exceptional rally earlier in the year—up 30.50% to an all-time high on 22 April—gold has since stabilised within the USD $3,200–$3,400 per ounce range. The precious metal initially surged on fears of US tariffs and their impact on global trade and equity markets. However, with the implementation of the tariffs now uncertain, investors appear to be in a holding pattern, awaiting further developments before making additional moves into or out of gold.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.