Market Review – March 2025

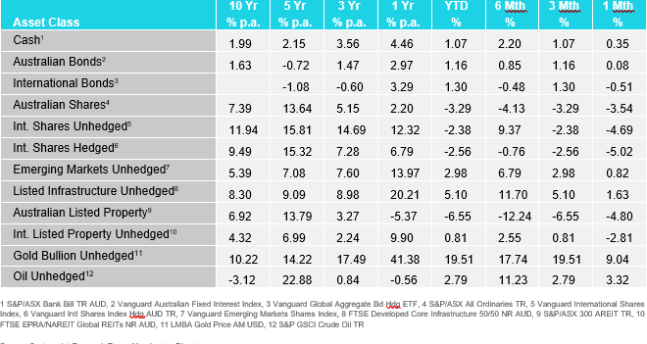

How the different asset classes have fared:

(As at 31 March 2025)

Key Themes:

- Equities Declined: Equities fell in March as investors continued to transition out of overvalued sectors into safer assets and sectors that had been neglected in 2024. This was compounded by ongoing uncertainty around the increasing number of US tariffs imposed by Donald Trump.

- Bond Prices Were Mixed: Australian bonds rose slightly, while international bonds fell marginally as investors considered lower-than-expected CPI reports and recession risks stemming from Trump’s policies.

- Australian Dollar Appreciated: The AUD mildly appreciated against the USD as the Australian 10-year government bond yield remained elevated relative to US yields.

- Both Gold and Oil Rose: Gold continued to perform strongly amid heightened market uncertainty. Oil prices increased as Trump announced further tariffs targeting Russian, Iranian, and Venezuelan oil.

International Equities:

International equities continued their decline in March, with unhedged equities falling by 4.69%, marking the worst monthly performance of the year so far. This weak performance arose from ongoing uncertainty about US tariffs under Donald Trump and how both US and global markets will respond to his announcement of additional tariffs on what Trump has dubbed “Liberation Day.”

The poorest performing sectors in March were the major winners from 2024: Technology (-8.94%), Consumer Discretionary (-8.24%), and Consumer Staples (-7.52%). These sectors returned 32.18%, 32.58%, and 20.46% respectively in 2024, and investors are now securing profits and shifting investments into less inflated sectors and regions due to growing uncertainty.

Consequently, the strongest sectors in March were Energy (4.35%) and Utilities (2.35%). These sectors, typically considered more defensive, had recently been undervalued compared to Technology, Consumer Discretionary, and Consumer Staples. Although the major players in AI have faced challenges in 2025, investor interest remains strong as they seek alternative ways to gain exposure. Energy and Utilities stocks have potentially benefited from this trend since AI and data centres require substantial power, creating increased demand which is beneficial for energy producers and utility providers.

Australian Equities

Australian equities also declined in March, dropping 3.54%. The Australian equity market mirrored negative global sentiment related to Trump’s tariffs and their associated uncertainty in global trade and equity markets. This negative sentiment saw all sectors decline, except for the traditionally defensive Utilities sector, which experienced minimal growth of 0.0088%.

The sectors most impacted were Technology, declining by 9.74%, and Consumer Discretionary, falling by 6.43%. Both sectors had delivered returns exceeding 20% in 2024 but have struggled in 2025 as investors secured profits amid ongoing global uncertainties.

Australian listed property also fell in March, declining by 4.80%, bringing the 6-month return to -12.24% as elevated interest rates continue to depress valuations.

Domestic and International Fixed Income

Australian bonds returned 0.08% in March. The Australian 10-year government bond yield increased by 7.8 basis points to 4.38%, while the two-year bond yield decreased by 5.7 basis points to 3.68%. Movements were minimal during the month as investors assessed the Reserve Bank of Australia’s (RBA) rate cut in February and economic data, including a slightly lower-than-expected CPI report for February.

International bonds returned -0.51% in March, with the US 10-year government bond yield rising by 1.4 basis points to 4.21%, and the two-year bond yield falling by 9.4 basis points to 3.89%. Yields have generally declined since the beginning of the year, though this slowed in March as investors awaited clarity on how additional tariffs might affect the US economy and potential recession risks.

Australian Dollar

Despite volatility throughout March, the AUD/USD exchange rate ended the month relatively stable, with the Australian Dollar appreciating slightly by 0.59% against the US Dollar. The USD initially fell significantly against most currencies early in the month due to uncertainty surrounding tariffs and interest rates. However, this effect diminished as Australia’s February CPI data came in below expectations.

Commodities – Gold and Oil

Oil prices rose by 3.32% in March. Initially, oil prices dropped early in the month due to anticipated higher supply from OPEC countries increasing production from April, coupled with lower global demand stemming from weaker economic growth. However, oil prices recovered following Trump’s threats and promises of additional tariffs on Russian, Iranian, and Venezuelan oil, potentially constraining supply and driving prices higher.

Gold again performed strongly in March, increasing by 9.04%. As a safe-haven asset, gold attracted investors amid pervasive geopolitical uncertainty driven by Trump’s frequent implementation and adjustments of tariffs and heightened tensions concerning Russia/Ukraine and Israel/Palestine.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.