Market Review – May 2025

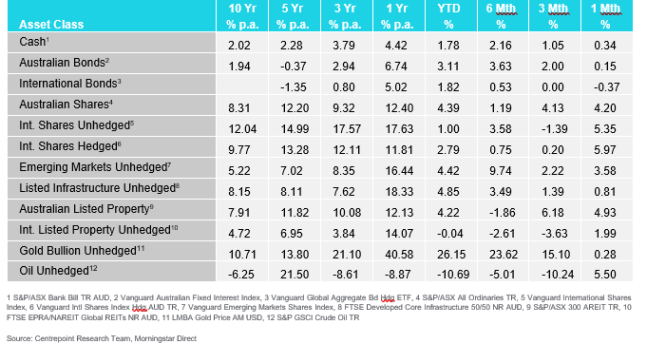

How the different asset classes have fared:

(As at 31 May 2025)

Key Themes:

· Equities performed well: Following the de-escalation of former President Trump’s initial tariff policies, investors rotated from defensive assets into risk assets. International equities outperformed, led by the US, while Australian equities also rose—albeit slightly less—as concerns remained about the future of China’s economy in a post-tariff environment.

· Bond prices were mixed: International bond prices fell after Trump’s reconsideration of the initial tariffs, easing inflation concerns. Australian fixed income rose over the month as the RBA cut interest rates in response to weak economic data.

· Australian dollar appreciated: Despite considerable volatility stemming from expectations of shifting trade dynamics, the Australian dollar strengthened in May.

· Oil and gold rose: Oil prices recovered over the month following a steep decline in April, as hopes of less severe tariffs boosted future demand expectations. Gold reached all-time highs before correcting, as investors shifted from defensive to risk assets.

International Equities:

Global equity markets rose in May 2025, buoyed by the continued de-escalation of Donald Trump’s aggressive tariff proposals. Over the month, the MSCI World Index gained 5.35%, led by the US, where the S&P 500 delivered its best May performance in 30 years and its strongest month since November 2023. The S&P 500 returned 5.49%, whilst the tech-heavy NASDAQ returned an even higher 7.92%. Notably, Tesla performed strongly after Elon Musk announced he would step down from his position within the US Government; consequently, its share price rose by over 23% during the month. The S&P 500 has climbed more than 18% since the market lows on 8 April, which were triggered by Trump’s “Liberation Day” announcements. Details of these tariff policies are likely to continue affecting global markets, particularly once the 90-day pause is lifted. The complexity of global supply chains presents challenges for analysts attempting to assess how individual companies will be impacted and, subsequently, how this will affect their earnings.

Elsewhere, European equities rose by 1.55%, led by Germany, where the government continues to discuss increased fiscal stimulus. Emerging markets also performed well following Trump’s revision of the tariffs on China and hopes that the final levy will be much less severe than the market initially feared.

Australian Equities

Australian equities also had a stellar month, returning 4.20%. The performance was driven by global relief at Trump’s decision to reconsider his initial tariff proposals. Although the proposed US tariff on Australian goods would have had a minimal impact on the economy, aggressive threats to Australia’s largest trading partner, China, had left the market vulnerable to a Chinese economic slowdown. Australian investors therefore welcomed the news of a tariff reprieve, allowing local equities to participate fully in the relief rally seen across global markets.

In May, the Reserve Bank of Australia cut the cash rate to 3.85%. Although this move was widely anticipated, the certainty of the decision provided an additional tailwind for equities. All sectors posted positive returns over the quarter, underscoring the breadth of the rally. Despite these gains, the Australian market lagged the global index due to its relatively smaller exposure to technology stocks, which led the global rally in May.

Domestic and International Fixed Income

International fixed income fell 0.37% in May. Bond yields generally rose, with the US 10-year Treasury yield climbing to 4.41%. This reflected rising fiscal concerns, a downgrade from Moody’s, and a shift to risk-on sentiment following the 90-day tariff pause, creating a headwind for defensive assets. Donald Trump’s latest bill, which outlined substantial unfunded tax cuts, exerted additional upward pressure on long-dated US Treasury yields as investors feared these cuts would ultimately be funded via the bond market. Although the tariff pause offered relief, it seemed to alleviate recession fears more than inflation concerns, putting further upward pressure on yields. European bonds followed suit and underperformed, mirroring these broad market anxieties.

In contrast to much of the global fixed-income market, Australian fixed income finished in positive territory after the Reserve Bank of Australia cut rates by 25 basis points. This move was prompted by weak economic-growth data, signalling the need to stimulate the domestic economy. While the cut was welcomed, investors remain vigilant about inflation to ensure post-COVID price pressures are firmly behind us. Moreover, ongoing tariff negotiations continue to pose risks to both global inflation and economic growth—factors that weigh heavily on fixed-income investors’ minds.

Australian Dollar

In May, the Australian dollar (AUD) experienced volatility; however, it ended the month by appreciating 0.74% against the US dollar (USD). Following President Trump’s tariff announcements, concerns emerged about the future strength of the US economy, which in turn weighed on demand for US goods. Despite the RBA’s rate cut widening the interest-rate differential between the US and Australia, investors remained focused on these tariff risks. Volatility was also driven by a series of US data releases, including stronger-than-expected employment figures and softer-than-expected inflation readings.

Commodities – Gold and Oil

Following a significant decline in April, oil prices rose by 5.50% in May. This rebound was largely driven by the de-escalation of the initial tariffs, which had threatened to dampen global oil demand. Despite the correction, prices remain below their pre-tariff levels, indicating that investors remain cautious about the global economic outlook.

Gold surged to a record high of USD $3,500 per ounce in early May. However, the prices soon retreated, dropping 7.5% from the peak earlier in the month, and ultimately closing down 0.28%. This pullback reflected the tariff de-escalation, which eased investor uncertainty and prompted a shift from defensive to risk assets. Profit-taking likely also played a role, given gold’s record peak. Year to date, gold is still up 26.15%.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.