Market Review – November 2025

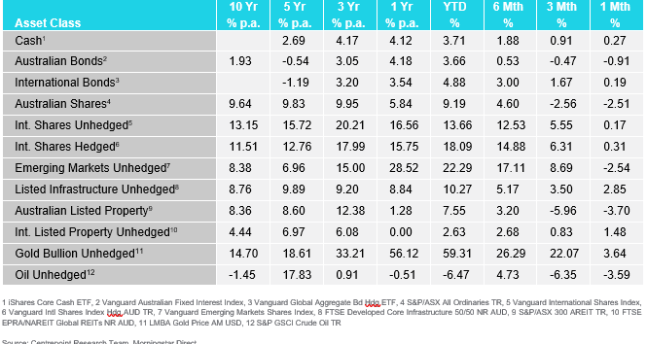

How the different asset classes have fared:

(As at 30th November 2025)

Key Themes:· Australian equities fell and international equities rose: Australian equities declined in November as investors continued to price in rate-cut projections. International equities posted modest gains despite concerns around the steep valuations of AI-related stocks.

· Bond yields fell internationally and rose domestically: Expectations of a potential rate cut from the US Federal Reserve pushed international bond yields lower. In Australia, higher-than-expected inflation led investors to push out the expected timing of RBA rate cuts.

· Australian dollar weakened: After a volatile month, the AUD finished marginally weaker against the US dollar.

· Oil fell, gold moves higher: Oversupply weighed on oil prices, while gold benefited from its safe-haven qualities.

International Equities:

In November, international equities finished broadly unchanged after experiencing significant volatility throughout the month. Early in the period, US equities recorded their worst five-day start to a month since 2008, as concerns grew about the durability of the AI investment theme and uncertainty increased regarding whether the US Federal Reserve would deliver the interest rate cuts already priced in for December. The sell-off was short-lived, with markets recovering in the second half of the month, supported by renewed optimism following positive earnings results from companies linked to the AI theme. Despite the late rally, the technology-focused NASDAQ Index declined by approximately 2 percent in November, ending its seven-month streak of gains.

Emerging markets were unable to maintain the strong performance seen in previous months; however, the MSCI Emerging Markets Index remains up more than 20 percent year to date. The asset class has benefited from several supportive tailwinds over the year, including a weakening US dollar, optimism surrounding Chinese AI development, and increased demand for commodities.

Australian Equities

In November, Australian equities declined by 2.51 percent after the Reserve Bank of Australia (RBA) signalled that interest rates may remain elevated for an extended period. The expectation of fewer rate cuts than previously forecast not only weighed on the domestic market but also contributed to a more cautious global sentiment, as investors questioned whether central banks worldwide could deliver the rate-cut projections currently priced in amid persistent inflationary pressures.

The Australian market also experienced a rotation out of several previously strong-performing companies, with Commonwealth Bank (CBA) falling more than 10 percent over the month following weaker-than-expected results. Additionally, softening materials demand held back the ASX in November, reflecting uncertainty over future commodity demand.

Domestic and International Fixed Income

International bonds ended the month marginally higher, returning 0.19 percent. While US bond yields did not move significantly in November, they edged lower as investors continued to price in another interest rate cut by the US Federal Reserve in December. This contributed to a steepening of the yield curve as markets accounted for lower short-term rates. Elsewhere, Japanese government bond yields continued to rise following the announcement of a ¥21.3 trillion fiscal stimulus package and another increase in inflation. In the UK, despite substantial pre-budget speculation, the Budget announcement proved largely uneventful, resulting in a relatively flat month for UK Gilts. Credit spreads widened against US Treasuries, while heavy supply in Europe further weighed on credit performance.

Australian bonds performed poorly, declining by 0.91 percent. Hotter-than-expected inflation in November (CPI at 3.80 percent versus 3.60 percent forecast) contributed to a broad rise in domestic bond yields. Longer-duration Australian bonds were particularly affected as investors pushed out expectations for future rate cuts. This has introduced fresh speculation about whether the RBA may need to raise rates in 2026, creating heightened uncertainty among investors.

Australian Dollar

The Australian dollar weakened against the US dollar by 0.13 percent in November. The currency pair was volatile throughout the month, initially slipping on broader risk-off sentiment before staging a brief recovery as concerns regarding the strength of the US economy placed downward pressure on the US dollar. The AUD then declined again as risk-off conditions re-emerged, followed by a late-month rally after disappointing Australian inflation data effectively extinguished expectations of an imminent RBA rate cut.

Commodities – Gold and Oil

The price of oil declined by 3.59 percent in November due to oversupply from OPEC+, although this was partially offset by new sanctions on Russian oil and an improvement in US–China trade relations.

Gold continued its upward trajectory, with year-to-date performance approaching 60 percent. Safe-haven demand and ongoing central bank buying have supported historically high levels of demand.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.