Market Review – October 2022

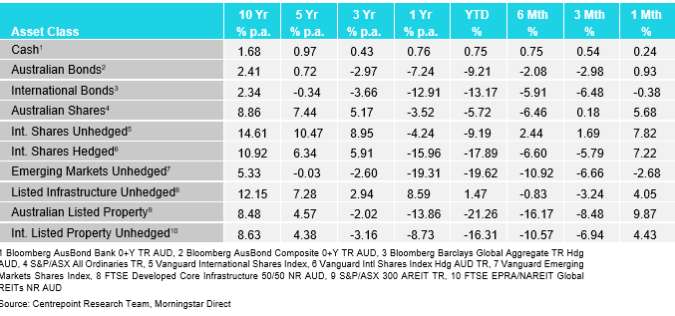

How the different asset classes have fared:

(As at 31 October 2022)

International Equities

In stark contrast to the prior month, international equities moved upwards in October as markets hoped for some reprieve from central banks raising rates. Hedged equities returned 7.22% and unhedged equities returned 7.82% on the month. If central banks paused or reversed their tightening cycle, equities would perceive that as very positive news. Whilst this rally in stocks is likely premature, equity holders are clearly desperate for lower rates and a loosening of central bank policy.

Australian Equities

Australian shares rose on the month, but not as strongly as international equities. Australian equities rose 5.68% in October and continued their relatively strong performance on the year relative to other countries around the world. The heavy-weighted materials sector dragged down the Australian Index when compared to other countries like the United States on the month. Energy and Real Estate had a strong increase, whilst Healthcare and Materials were the worst performers.

Domestic and International Fixed Income

Australian bonds had a positive month with a 0.93% rise. International bonds conversely fell slightly with a -0.38% return. Australian interest rates eased on the month as signs of housing weakness started to show. The RBA rose rates again during the month but only by 0.25%, signalling they are trying to balance fighting inflation with avoiding a significant economic slowdown which would be caused by interest rates going too high. This is a difficult balancing act.

Australian Dollar

The Australian Dollar (AUD) only fell 0.54% in the month of October. This was relatively mild compared to the prior months where the United States Dollar (USD) has been on a relentless upward trajectory. Intra-month the AUD fell 3% and then reversed course. Some weakness crept into the USD as markets hoped for signals of a tapering down in interest rate increases. Economic data is largely driving markets currently. If inflation shows signs of moderating somewhat in the US, the AUD will have some potential to rally.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.