Market Volatility – May 2022

UNDERSTANDING THE RECENT MARKET VOLATILITY

Prepared by: Centrepoint Alliance

May 2022

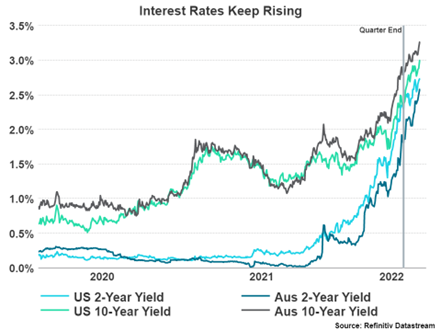

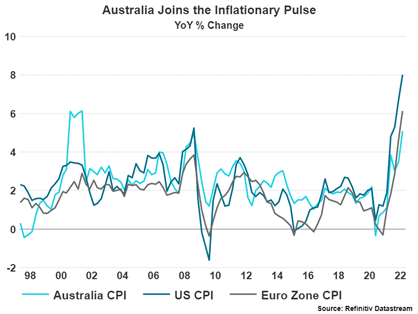

1. Interest Rate and Inflation expectations keep shifting upwards

Over the last few months, interest rates have continued to move higher on both the long and the short end. With inflation finally showing its head in the last Australian CPI print, Australian bonds (as well as international bonds) have had yields increase significantly.

The RBA (Reserve Bank of Australia) has changed their view that interest rates needed to remain extremely accommodative until 2024 as the Australian economy has shown strength via the unemployment and GDP numbers. This is combined with the inflation numbers in the Australian economy not only increasing to a 21-year high but increasing across broad areas of the CPI basket and above expectations of the RBA.

This has resulted in the RBA, for the first time in 11 years increasing the Cash Rate by 0.25%. It now sits at 0.35%, up from 0.1%. The RBA has also indicated that they will start decreasing their balance sheet simultaneously with most of this tightening occurring in 2023 and 2024.

The RBA has made it clear that they expect higher inflation to continue. The source of this inflation is from both supply shocks stemming from the zero-covid policy enacted in China and the war in Ukraine, and also increases in domestic demand putting pressure on available capacity. Their medium-term expectations are that inflation will return to the upper end of their inflation range (3%) by 2024.

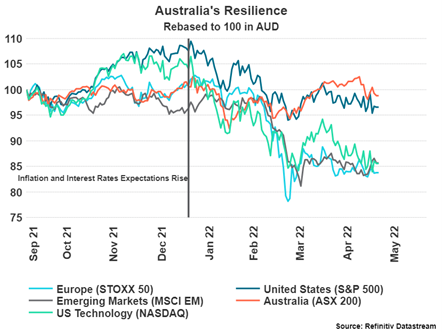

2. Cumulation of negative factors pressure equities

The repricing in of inflation and interest rate expectations have put pressure on equity markets, most namely the NASDAQ. Markets have been accustomed to accommodative monetary policy for many years and are now having to deal with a very different macroeconomic environment that puts stress on the most speculative parts of the market.

Australian markets have held up well during the volatility due to the number of materials, energy, and financials companies in the index. These companies tend to do well during inflationary periods.

The war in Ukraine has also impacted the European markets primarily but has had economic supply impacts across most of the world. This situation is not abating and remains dynamic in how the world will continue to be impacted. Food supply issues have been brought up as a rising concern due to the fertiliser supply from the Ukraine/Russia region being heavily impeded. The casual discussion by Russia of their willingness to use nuclear weapons if they deem necessary is an escalation not seen since the Cold War.

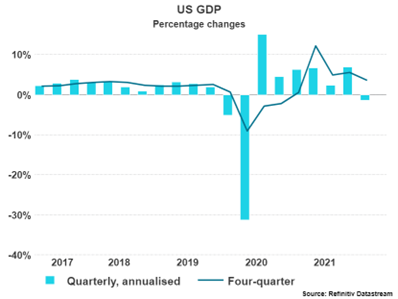

3. The coming slowdown and what this means for equities and bonds

Centrepoint Research outlined the first warning signs of a coming economic slowdown. Since then, the United States has reported an unexpected 1.4% drop in quarterly GDP growth verses an expected 1.1% gain. Whilst one quarter does not indicate a trend, the unexpectedness of the number is the primary concern. Research expects this slowdown start showing in Europe as the war in Ukraine continues to drag on the region.

If a slowdown is coming, what does this mean? It will mean that central banks will have to rethink how aggressive they can be with interest rates. A lot of interest rate increases are now priced into markets, and this is likely to be a positive for both equities and bonds if these expectations of increases must be wound back to some degree. Remember, interest rate increases are ultimately not positive for equities or bonds. A return to a low growth environment (which has been the case for the last 10+ years) is likely to occur in the medium term. This slowdown may not take place until 2023/24 as interest rate increases take time to impact economies. Value stocks have performed well over the last few months, these companies tend to be in the materials and energy sectors. An economic slowdown would see these companies start to struggle as they are closely tied to economic growth.

The short term remains highly unpredictable and diversification across asset classes, regions and styles remains the best strategy. Ensuring that there are strategies with defensive capabilities in each component of the portfolio is recommended as inflation will remain elevated and interest rates should continue to move higher. Inflation is likely to remain elevated due to the continuing supply pressures seen around the world and therefore allocations to real assets is still recommended.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.